PROCURE TO PAY

A Guide to Procure-to-Pay (P2P) Process

Table of Contents

Introduction to Procure to Pay

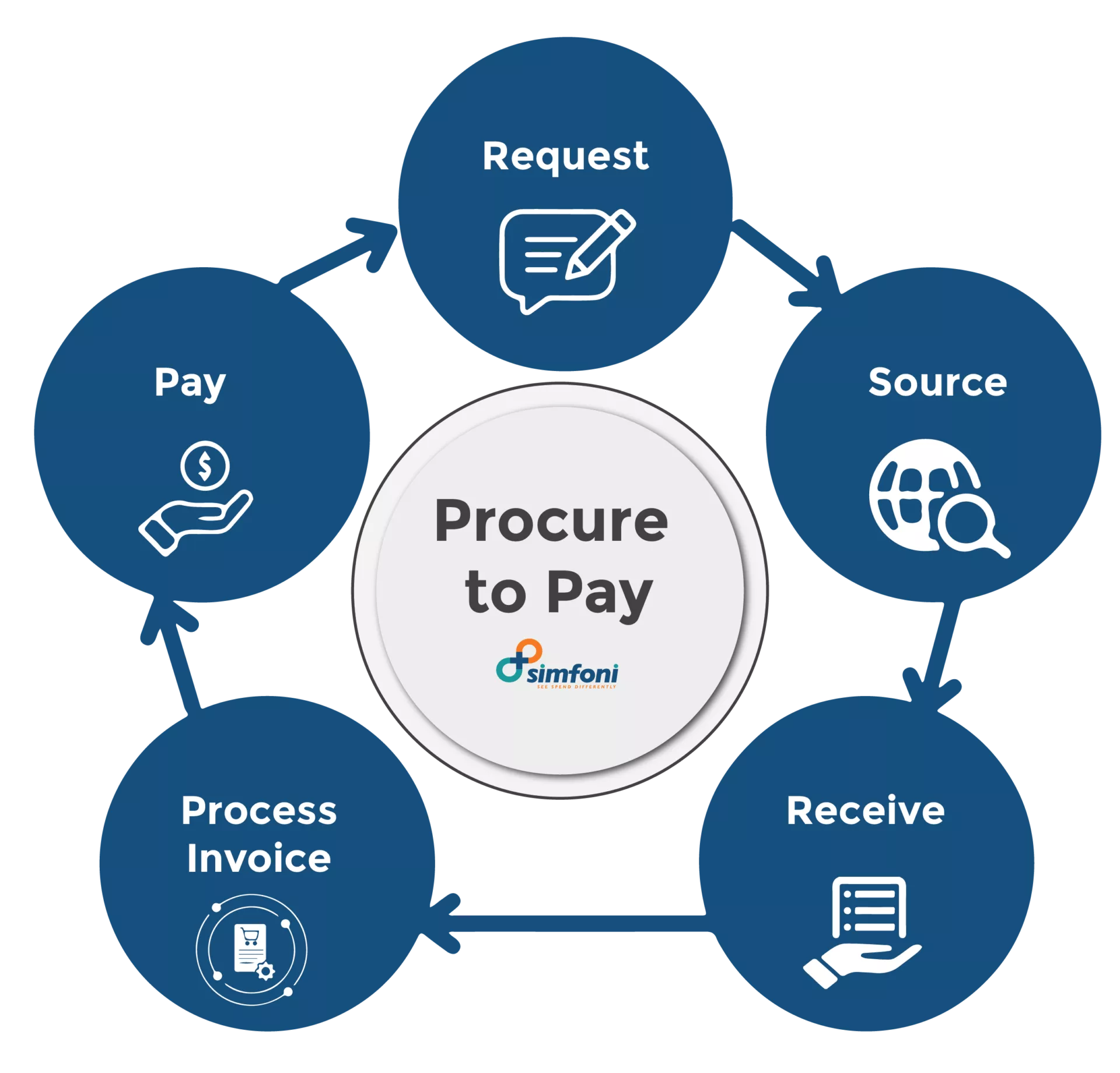

Procure to Pay or P2P in procurement is defined as an automated system that streamlines the process of requisitioning, purchasing, receiving, and paying for goods and services. It involves end-to-end integration with accounts payable, invoice management, and vendor payment systems to ensure compliance, accuracy, and efficiency. The Procure-to-Pay process is carried out to centralize procurement and control the entire life-cycle of a transaction to gain financial visibility across the organization.

Simfoni.com Tweet

If you operate any kind of business, whether it’s traditional, digital, or hybrid, you need to know about the procure-to-pay process and the automated solutions that can help you manage it.

Your procurement and accounts payable teams should be able to examine the progress of a transaction at any moment, from the time a product or service is purchased through the time an invoice is paid.

We’re going to speak a lot about the procure-to-pay continuum in this post, including what exactly is procure to pay and how to use digital technologies to help.

What exactly is Procure to Pay?

The process of linking purchasing and accounts payable systems to increase efficiency is known as procure-to-pay. It is part of a wider procurement management process that has four stages: choosing products and services, enforcing compliance and order, receiving and reconciliation, and invoicing and payment.

Procure-to-pay software solutions may help you improve compliance and control among suppliers, contracts, regulations, buyers, and accounts payable by digitizing your procurement process. Process automation using procure-to-pay software may enable firms to acquire from chosen suppliers at agreed pricing without the human paperwork and spreadsheet difficulties.

- Actively manage and improve overall spending.

- Reduce mistakes by consolidating the majority of manual commerce operations.

- Make catalog maintenance more efficient, saving time and resources.

- Facilitate the approval of new suppliers promptly.

- Increase the value of sourcing discussions by driving savings to the bottom line.

What procedures are covered by Procure-to-Pay?

Requisitioning, purchasing, and payment are the three key stages in the procurement lifecycle covered by the phrase Procure-to-Pay, also known as Purchase-to-Pay or P2P.

The Procure-to-Pay procedure includes everything from product research to updating accounts payable. Between these two stages, the following activities may be found :

- Conduct a product search

- Add items to a shopping cart

- Make a purchase order requisition.

- Completing and authorizing the purchase

- Produce a purchase order.

- Take delivery of the products

- Verify that the order is in order.

- Recieve the bill

- Process and reconcile the invoice

- Make the payment on the invoice

- Make any necessary changes to the accounts payable.

Each company’s Procure-to-Pay process is unique, and it may incorporate extra steps.

Read More:- Guide to eSourcing Software & Tools by Simfoni’s Procurement Professionals

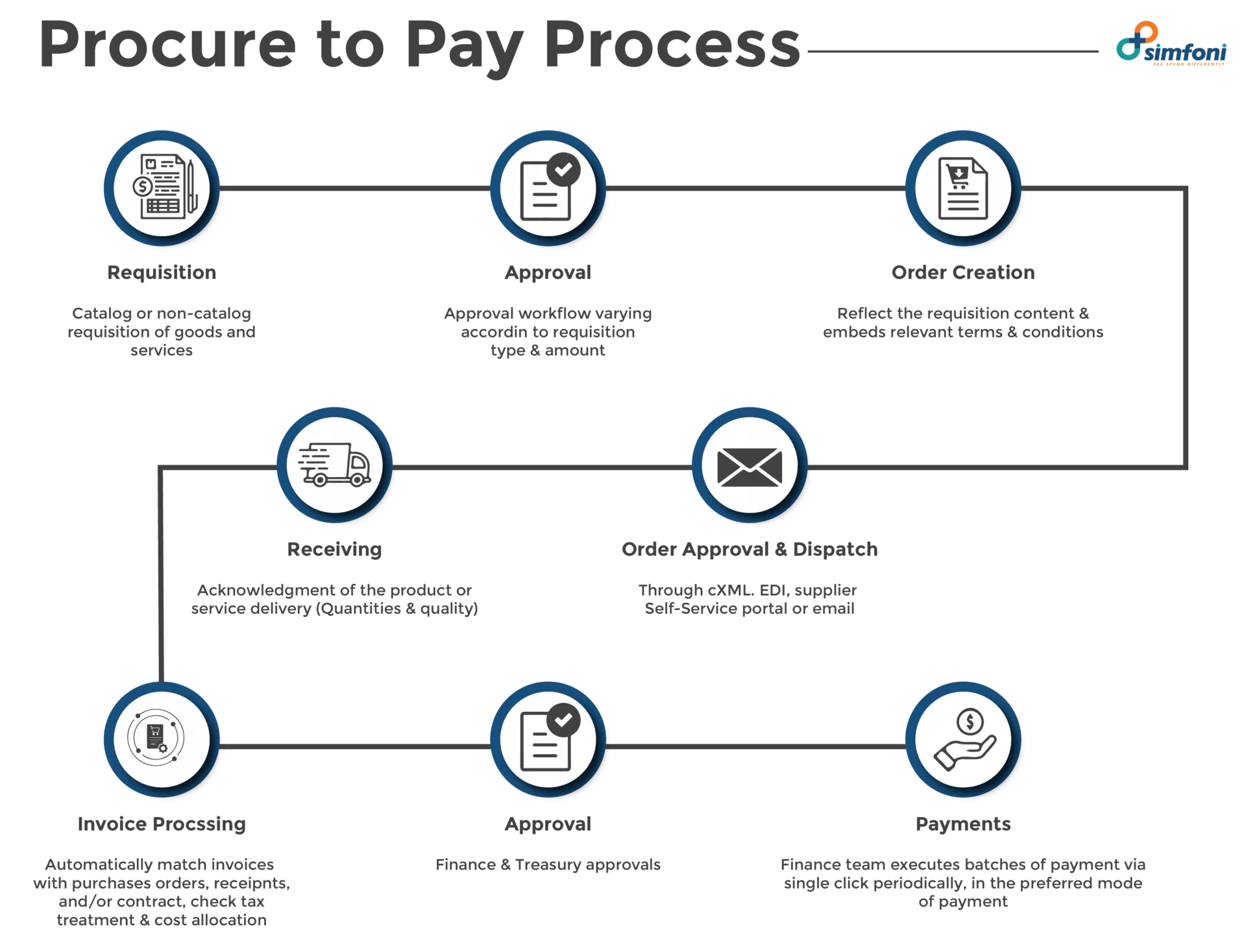

Procure-to-Pay Process Flow

The procure-to-pay process flow (also known as the procure-to-pay cycle) includes various actions, such as :

1. Identification is required.

Identifying the need for certain products and services, as well as the available money for the purchase.

2. Purchasing goods

Researching vendors, checking up on items, and negotiating costs are all possible steps in this process. As a result, businesses can source items from an approved catalog or by sending out a request for quote (RFQ) to suppliers, asking them to specify what products or services they can give and how much they would cost.

3. Requisition

When a vendor has been chosen, the buyer will enter the requisitioning step to formalize consent for the purchase.

This is accomplished by preparing and approving a requisition order, an internal document used when a purchase is required. The products being purchased, as well as the vendor’s quote and any delivery instructions, will normally be included in the requisition order.

4. Placement of Procurement Orders

When a customer places an order, he or she will issue a purchase order that contains information such as the kind, price, and quantity of the items or services being purchased. The supplier will be notified.

5. Order Acceptance

Receiving items from the supplier, comparing them to the purchase order’s specifications, identifying any damage that may have happened during shipment, producing a receipt, and putting information into the appropriate systems are all part of this process.

6. Invoices from vendors

The supplier will send the buyer an invoice that specifies the amount due and the due date. Purchase orders and invoices must be reconciled, and applicable systems must be recorded.

7. Payable Accounts

Paying supplier bills on time and accounting for transactions are all part of the accounts payable process.

The purchasing business will need to ensure that vendor payment data are up to date as part of this process, as well as take precautions to prevent accounts payable fraud.

8. Reporting

After the supplier has been paid, the firm may evaluate the process to see if there are any areas where it can be improved in the future.

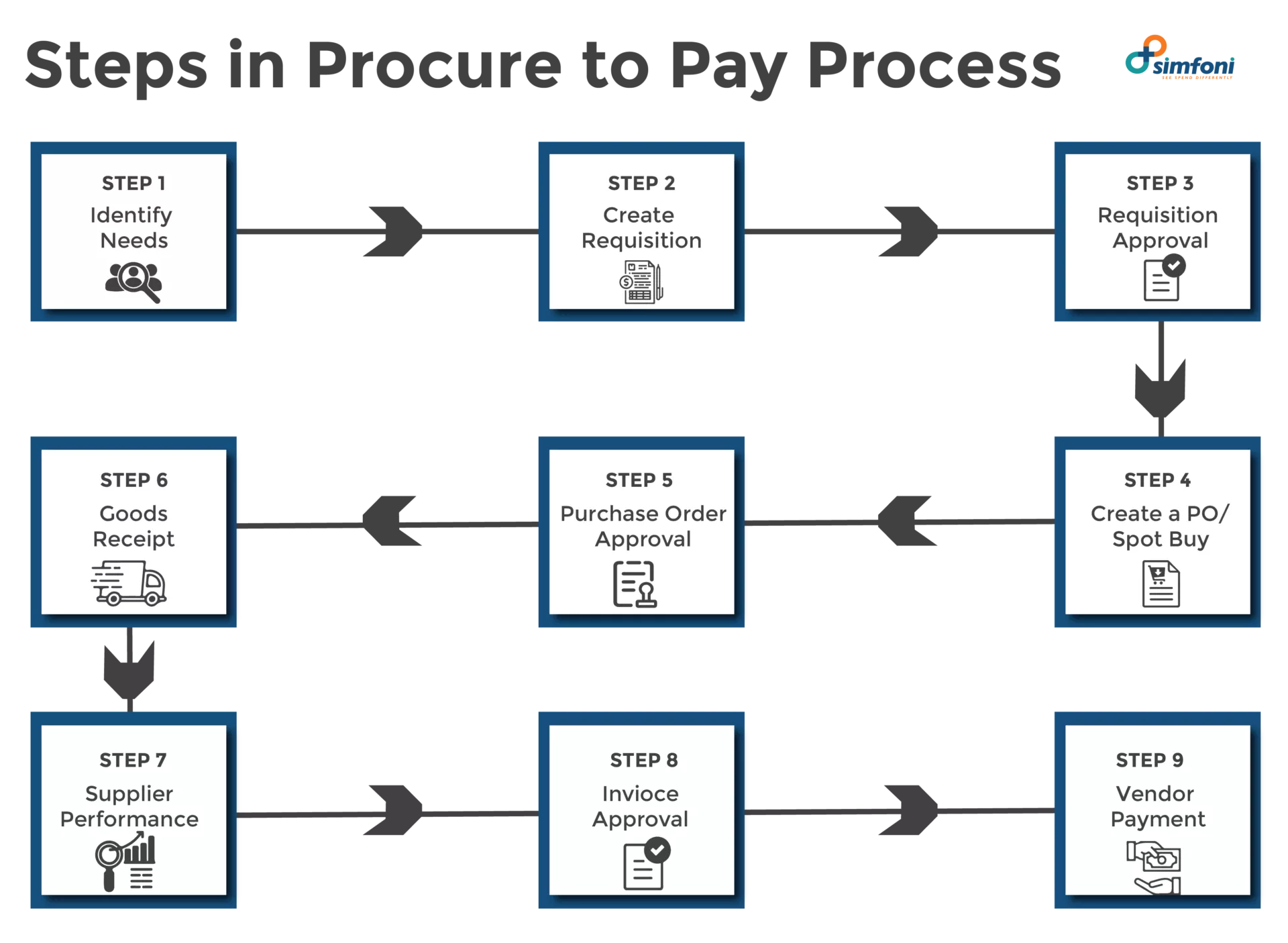

Procure-to-Pay Process Steps

Procurement management within a purchasing company can benefit significantly from e-procurement, which includes :

1. Choosing products and services

Employees choose specifications for items and terms of reference or statements of work for services based on previously determined company needs. After that’s taken care of, they select the necessary components from supplier catalogs or other available sources.

2. Creating purchase requisitions is a time-consuming process.

Purchase requisitions (also known as purchase orders) are official requests for products or services (including subcontracts and consignments) that are required for company operations. The requestor fills out the purchase information, double-checks that it complies with administrative regulations, and then submits the PR for approval.

3. Purchasing authorization

The approval chain is then reviewed and either authorized, rejected, or sent back to the originator for adjustment by team leads, department heads, procurement officials, or top management (depending on the organization’s structure). The majority of the choice is based on the requirement assessment and the available money.

4. Ordering

The requester would normally build a purchase order from the accepted requisition and deliver it to the designated vendor. The PO becomes a legally enforceable contract after the supplier acknowledges the order. The employee, on the other hand, may execute a spot buy if the purchase is one-time, from an uncontrolled expenditure category, or of low value. To guarantee compliance and specification correctness, certain companies may have a distinct approval system for purchase orders.

5. Goods and services are received and inspected.

To evaluate the supplier’s performance, the customer should inspect the items or check services after delivery. For the product receipt to be accepted by the buyer, quality, delivery schedules, Total Cost of Ownership, and other metrics indicated in the PO must conform with the contract requirements.

6. Receiving the invoice and doing the reconciliation

It’s time for a 3-way match between the PO, the receipt, and the invoice when the responsible employee authorizes the products and services receipt. The invoice passes through the review process and is sent to the finance department for payment if there are no issues. In the event of a discrepancy, the firm rejects the invoice and returns it to the supplier with a reason.

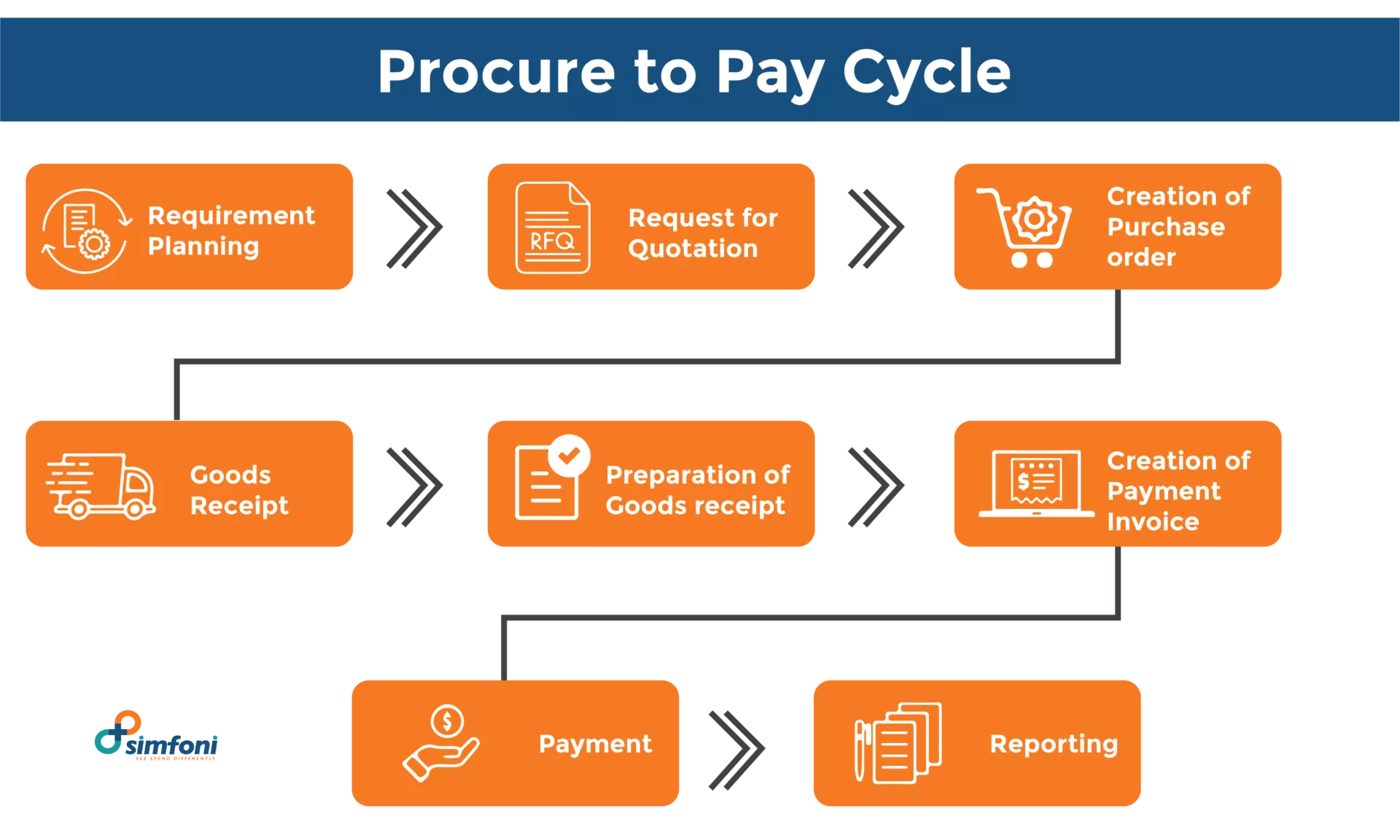

Procure to Pay Cycle

The Procure-to-Pay cycle refers to the end-to-end purchasing process’s repeated consecutive steps done in tight order.

Requisitioning, purchasing, and payment are all covered under the procure to pay procedure.

The procure-to-pay cycle isn’t meant to speed up the vendor payment process because clearing bills faster hurt the company’s cash flow and prohibits them from keeping their cash for as long as feasible.

Benefits of Procure-to-Pay (P2P) solutions?

Users are presented with suppliers’ items (through Punch-Out catalogs, e-catalogs, and APIs) before the procurement and finance processes are digitized, automated, and enhanced. They include actions like control, verification, validation, and document management, allowing businesses to have more control over their purchases and increase efficiency.

As its name indicates, a Procure-to-Pay (or Purchase-to-Pay) system is a fully integrated solution designed to enable an end-to-end process that starts with products and services requisitioning and concludes with ready-to-play files for upload into an accounts payable system. To enable suppliers to submit invoices electronically, procure-to-pay systems employ a scan-and-capture service, a supplier portal, and/or a multi-enterprise network. Procure-to-Pay systems enable purchase-order-to-invoice matching and processing for invoices that don’t match or when products are returned, in addition to fundamental e-procurement features (such as e-requisitioning, approval workflow, and e-catalog management).

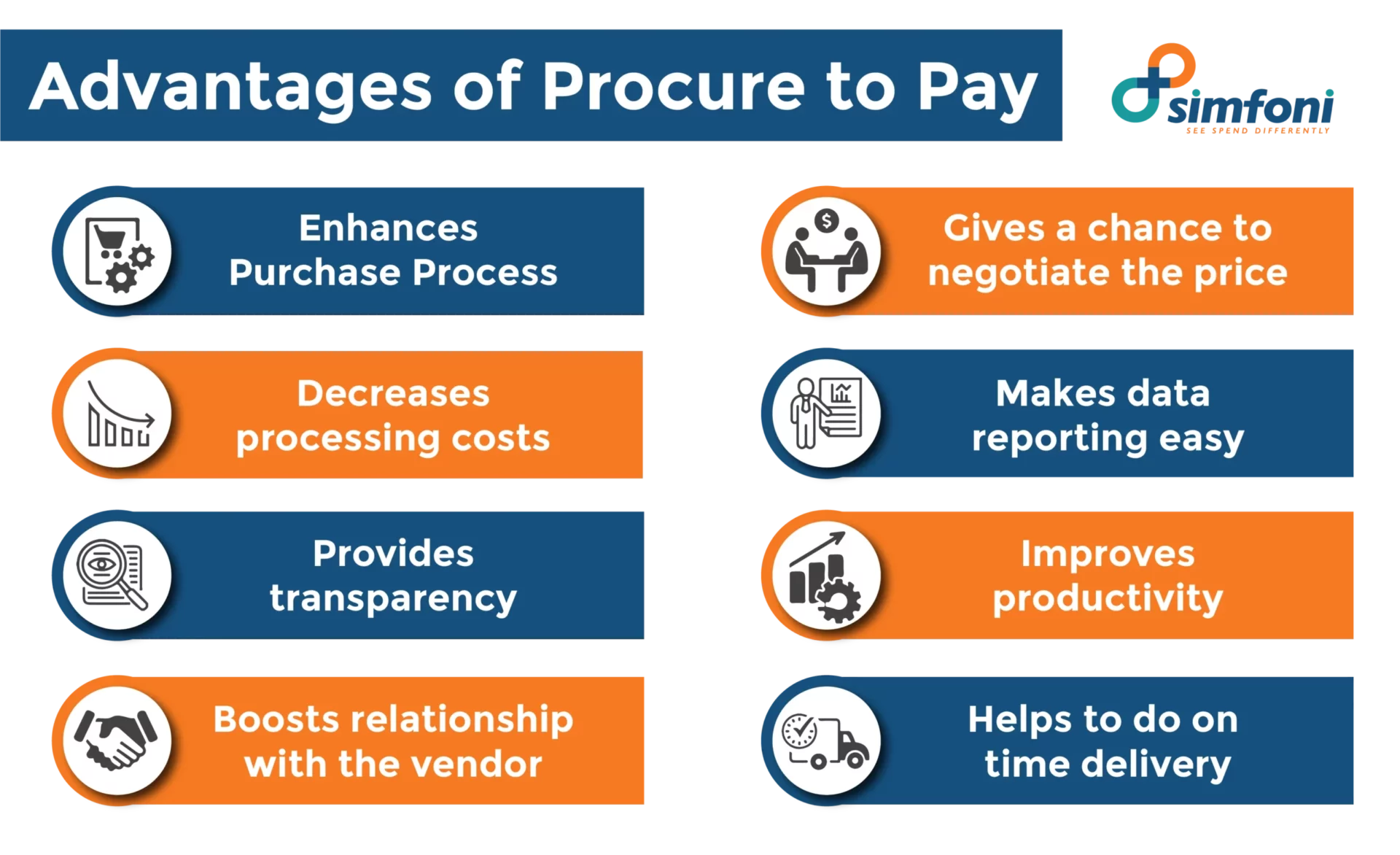

Advantages of using a Procure-to-Pay System

Procure-to-Pay systems can help procurement departments improve their performance by :

Enhancing the efficacy of processes

Manpower costs, processing times, and dangers are all reduced by automating procedures.

Gaining more control and visibility

Consolidating and collecting data allows businesses to have a better understanding of their spending and exert more control over it.

Teams’ upskilling

Procurement teams may focus on objectives with more strategic value for the firm rather than spending time on manual and repetitive administrative activities.

Procurement divisions can focus on value-added responsibilities like sourcing, innovation, end-user intimacy, and strategy since the Procure-to-Pay process is very simple to automate.

The Procure-to-Pay Process Flow

Procurement executives select to complete the most important steps of the procure-to-pay process based on corporate practice and the demand in the issue.

Simfoni’s Procurement technology and solutions can help with this. You may tailor your flow to your company’s requirements. However, here’s an example of a basic procure-to-pay method.

Step 1: Determine your requirements.

With the support of cross-functional stakeholders, develop and define the business needs as the first stage in the procure-to-pay process. Procurement teams draw out high-level specifications for goods/products, terms of reference (TOR) for services, and statements of work after a legitimate requirement is recognized (SOW).

Step 2: Create requisitions.

A formal purchase requisition is generated when the specifications/TOR/SOW are finalized. After verifying that all essential administrative criteria are satisfied, the requester submits the completed purchase requisition form.

From ordinary purchases to subcontracts and consignments, requisitions may be produced for any sort of procurement.

Step 3: Approval of the purchase requisition.

Department heads or procurement officials evaluate purchase requisitions that have been submitted. After reviewing the requirement, checking the available budget, and authenticating the buy request form, approvers can either approve or reject the requisition. Purchase requisitions with missing information are returned to the originator for rectification and resubmission.

Step 4: Make a purchase order (PO) or a one-time purchase.

A spot buy can be done if the requested goods/products are unmanaged category buys, one-time unique purchases, or low-value commodities. Purchase orders are generated if purchase requisitions have been authorized.

Step 5: Approval of the purchase order.

To verify the legality and correctness of specifications, purchase orders are now passed through an approval loop. Purchase orders that have been approved are subsequently sent to vendors. Vendors can approve, reject, or initiate a negotiation after examining the purchase order. A legally binding contract is activated when an officer authorizes a purchase order.

Step 6: Receiving the goods.

The buyer inspects the supplied goods or services to confirm that they comply with the contract requirements after the provider delivers the promised goods or services. The goods receipt is then authorized or denied depending on the purchasing contract or purchase order’s specifications.

Step 7: Performance of the supplier.

The supplier’s performance is assessed using the information gathered in the previous stage. Quality, on-time delivery, service, contract compliance, responsiveness, and Total Cost of Ownership are all issues to consider (TCO). For future reference, non-performance is reported in existing rosters and information systems.

Step 8: Approval of the invoice.

A three-way match between the purchase order, the vendor invoice, and the receipt of the goods is done after a goods receipt is accepted. The invoice is authorized and sent to the finance team for payment distribution if no problems are discovered. In the event of errors, the invoice is denied and returned to the seller with an explanation.

Step 9: Make a payment to the vendor.

The finance team will execute payments by the contract conditions after an invoice has been accepted. Any contract revisions or financial security liquidation evaluations will be considered. Advance, partial, progress or installment, final, and holdback/retention payments are the five types of payments made to a supplier. In the procure-to-pay process, there are several best practices to follow.

The following five best practices can assist firms to enhance their procure-to-pay process’ efficiency and effectiveness :

- Procure-to-pay software should be implemented.

- Maintain transparency throughout the process.

- Boost supplier participation.

- Inventory should be optimized.

- Streamline contract administration

Advantages of Procure-to-Pay Software

According to recent Simfoni research, more than half of all enterprises across the world will have implemented a cloud-based procure-to-pay suite by 2025. As companies discover more about the benefits and cost-saving prospects of adopting procurement software, cloud-based procurement systems like Simfoni are gaining favor.

The following are some of the ways you may improve buying efficiency.

1. Purchase orders and approvals

A digital procure-to-pay program eliminates email threads by routing the purchase request to all stakeholders and approvers in the correct order.

2. Management of purchase orders

The majority of procure-to-pay systems generate purchase orders automatically from approved purchase requisitions and start the PO dispatch process. It’s possible to do everything from submitting several batch orders to a single vendor to creating many Pos from a single PR.

3. Digital Vendor management

When it comes to vendor management, going digital impacts how your procurement team evaluates and ranks vendor performance. Choosing the ideal vendor based on performance, pricing, discounts, delivery schedule adherence, and policy compliance is a breeze with the correct procure-to-pay platform!

4. Checking invoices

For example, is a procurement-to-payment program. Organizations may use procurement to do three-way matching to assure a risk-free purchase, authorize invoices, handle exceptions, and interact with electronic payment or account payable systems.

5. Purchase-related insights

One of the finest aspects of automation is that reporting and procurement analysis assist you to figure out what is and isn’t working. It provides end-to-end transparency. As a result, you can rapidly check the progress of every work, monitor vendor performance indicators, and more with custom reports and analytics.

Procure-to-Pay Process Challenges

The procure-to-pay cycle, as previously said, consists of various phases. Typically, they will entail activities by a variety of employees across various departments within the firm, ranging from procurement to finance, who will be using a range of platforms. People participating in procure-to-pay may have conflicting or even opposing agendas and objectives.

These characteristics can result in a variety of issues, ranging from a lack of reliable data across the whole procure-to-pay cycle to the likelihood of mistakes due to manual operations. Companies may attempt to solve these issues by automating their procure-to-pay processes to improve efficiency, visibility, and intelligence.

Best Practices and KPIs for Procure-to-Pay

Procurement-to-Payment Process Best Practices

You may increase efficiency and effectiveness by following the best practices listed below :

- Implement an automated procure-to-pay system.

- Ensure that the peer-to-peer (P2P) mechanism is always transparent and traceable.

- Collaboration between procurement and accounts payable should be improved.

- Boost supplier satisfaction and engagement.

- Create quantifiable objectives and keep track of your progress.

Procure-to-Pay Cycle Key Performance Indicators

Even though each company is unique, the following key performance indicators (KPIs) are used to evaluate the procure-to-pay process :

- The time it takes to complete a purchase order

- The average cost of completing a purchase order

- Time to market

- Processing time for electronic Pos

- The time it takes to process an invoice

- An invoice’s average processing cost

- The rate of invoice exceptions

- Rate of first-time matches

- The time it takes to approve an invoice on average

- Outstanding days payable

- Management of spending

- Savings realized

- Discounts were taken advantage of.

Procure-to-Pay Automation’s Advantages

The procurement and accounts payable teams, as well as the company as a whole, gain from automating the procure-to-pay process. These advantages include :

1. Processes should be simplified.

By removing time-consuming and error-prone human procedures from procure-to-pay operations, P2P automation generates cost savings and processing efficiency. You can collect 100% of your financial data and gain the highest levels of insight across the supply chain when you fully automate your procurement and payables procedures.

2. Increase Supplier Relationships

You may connect with your suppliers in an automated and simplified manner using automation. You may connect with all of your suppliers – from the largest to the tiniest – by utilizing a variety of techniques to communicate with them and share data and documents. P2P automation also improves supplier relationships and cooperation by increasing on-time payment performance and providing real-time visibility into transaction progress.

3. Maverick Spending should be eliminated.

Providing an electronic procurement (e-procurement) solution that allows end-users to rapidly locate and acquire exactly what they need is a good method to verify compliance with purchasing rules and negotiated contracts. Users will embrace a system with an easy-to-use interface, a powerful underlying data architecture, and directed purchasing, allowing them to stay compliant with procurement rules and reducing maverick expenditure.

4. Improve Control and Visibility

CFOs and CPOs are increasingly focused on cost conservation and spending management while avoiding operational interruptions. P2P automation solutions offer improved strategic decision-making by providing a comprehensive picture of your suppliers and spending from a single, central place. You’ll be better able to control expenditure, minimize risk, and manage the whole supply chain if you have access to data and visibility into your company’s spending.

Read More:- Comprehensive Guide to Tail Spend Management.

Procure to Pay software

End-to-end procure-to-pay solutions are available from some suppliers, to automate the entire P2P process.

From vendor management platforms to systems that automate the production of requisitions and the issuance of purchase orders, technology may play a role in expediting key components of the procure-to-pay cycle.

Furthermore, invoice automation systems may help businesses streamline invoice data gathering, decrease the risk of mistakes, and automate accounts payable operations.

Vendors, too, may limit the risk of mistakes or delay in the bills they send to their customers by utilizing electronic invoicing systems that guarantee invoices are sent to the correct location and in the correct format. Solutions that transform purchase orders into invoices automatically, as well as a system-to-system connection for huge numbers of invoices, are among them.

Procure-to-Pay Flowchart

o Requisition for Purchase has been submitted.

Purchase requisitions are official requests for products or services to be purchased. Most requisitions are established and put into the procurement strategy when every item can be described in advance. Even the most meticulously laid-out plans may require more supplies owing to spoilage, unanticipated occurrences, client scope creep, or new ideas for improving the original design. Budgets for procurement plans that are well-crafted provide a buffer for such eventualities and requisition orders can be issued later in the process if necessary.

1. Selection of Vendors.

The vendor selection procedure may need to be used for new orders. The procurement department issues a request for proposal (RFP) stating the criteria, based on a limited list of bidders. Suppliers submit a bid for the task, which includes information such as turnaround time, pricing, and material specs.

Negotiations take happen as part of the supplier selection process. Aside from quality, pricing, and delivery dates, the procurement department will look into prospective benefits like :

- Price drop compared to the previous year

- Discounts for large orders

- Quality will improve in the future.

2. Costs of transportation and insurance

Requirements for compliance must also be considered. The industry may be bound by government regulations, and the corporation may have a socially aware mission ingrained in its culture.

Consumers are becoming increasingly concerned about corporate social responsibility, and organizations are required to achieve specific sourcing requirements to impress their customers and prevent unnecessary risk exposure.

For example, to prevent a public reaction, several corporations have committed to fair-labor and environmental criteria that contractors must be able to satisfy.

After all of the short-listed vendors have concluded their discussions and the best offer has been discovered, a supplier is picked based on the procurement plan’s selection criteria and a purchase order is issued.

3. Issuance of a Purchase Order (PO)

A complete order form with amounts and delivery criteria is submitted when the requisition order has been authorized. For fulfillment, the PO is forwarded to the relevant vendor.

4. Documents Received and Filed

The vendor provides the products or services, and the appropriate receiving paperwork is filled out, with line items double-checked to confirm that everything on the order is delivered.

5. The invoice has been received.

The vendor sends in an invoice, which is then processed by the system. Vendor portals are frequently used in automated systems to assist with electronic invoicing (eInvoicing).

6. Reconciliation of Invoices

The invoice is compared against the purchase order and any other necessary papers from the receiving procedure. The three-way matching procedure, also known as invoice matching, checks the purchase order and receives a document with the invoice in automated systems to ensure that the products were delivered and billed correctly. Unmatched line items are identified and submitted for further examination.

7. Accounts Receivable

Your finance staff sends invoices to AP that have been approved for payment. The accounting system is updated, and vendor payments are made.

Procure-to-Pay System That Works

Many things might change throughout a project or calendar period, and keeping the P2P system in top operating condition necessitates meticulous attention to detail. In an ideal world, the procurement and accounts payable teams keep in frequent communication with suppliers, cultivating positive working relationships that encourage vendors to bargain in good faith with customers who pay their bills on time and keep their promises.

Raw material costs can rise or fall as a result of anything from natural catastrophes to political events, influencing every link in the supply chain. For procurement and AP professionals who want to accomplish strategic sourcing while keeping costs low across the whole purchasing process, supply chain management and supplier relationship management are just as important as process efficiency and data management.

The genuine value of a comprehensive procure-to-pay solution, on the other hand, comes in its capacity to facilitate open communication and entire transactional transparency between procurement and accounts payable departments. Consider the following scenario :

- The purchase order and invoicing cycles are streamlined thanks to centralized data management, automated routing, notifications, and contingencies, which ensure automatic three-way matching.

- All of your data is brought together in one place for easy, mobile-friendly access for all stakeholders thanks to integration with your existing enterprise resource planning system (ERP system) and accounting software.

- Artificial intelligence and process automation decrease human error, expedite processes, eliminate time-consuming manual chores, and allow employees to devote their time and expertise to higher-value jobs while still being able to investigate and solve issues as required.

Vendor management is substantially enhanced by implementing the following strategies :

Total data transparency, real-time reporting, and centralized contract administration are just a few of the features available.

- A closed purchasing environment that keeps maverick spending, invoice fraud, duplicate/late payments, and late penalties out while allowing for greater early-payment discounts to be captured.

- Cultivation of long-term, strategic supplier relationships that enable firms to create powerful alliances with their finest suppliers while reducing supply chain bloat by removing under-performers.

- When both essential participants have the tools they need to monitor and improve expenditure, vendor management, and workflow efficiency, they may create a P2P process that saves money and adds value to their businesses.

What is the Procure-to-Pay cycle, and how does it work?

The procure-to-pay cycle is a business’s systematic method for purchasing and paying for raw materials and services. Procurement operations are linked to an organization’s accounts payable department in this cycle. The major responsibilities of this department are to keep track of how much money a company owes its suppliers and creditors, as well as to ensure that correct payment are paid to these parties. Procurement will be simplified and efficient as these two procedures are connected. Because it needs accounts payable teams, procurement departments, and suppliers to interact, well-developed pay systems will also improve transparency. Furthermore, being in frequent communication with vendors will aid in supplier management.

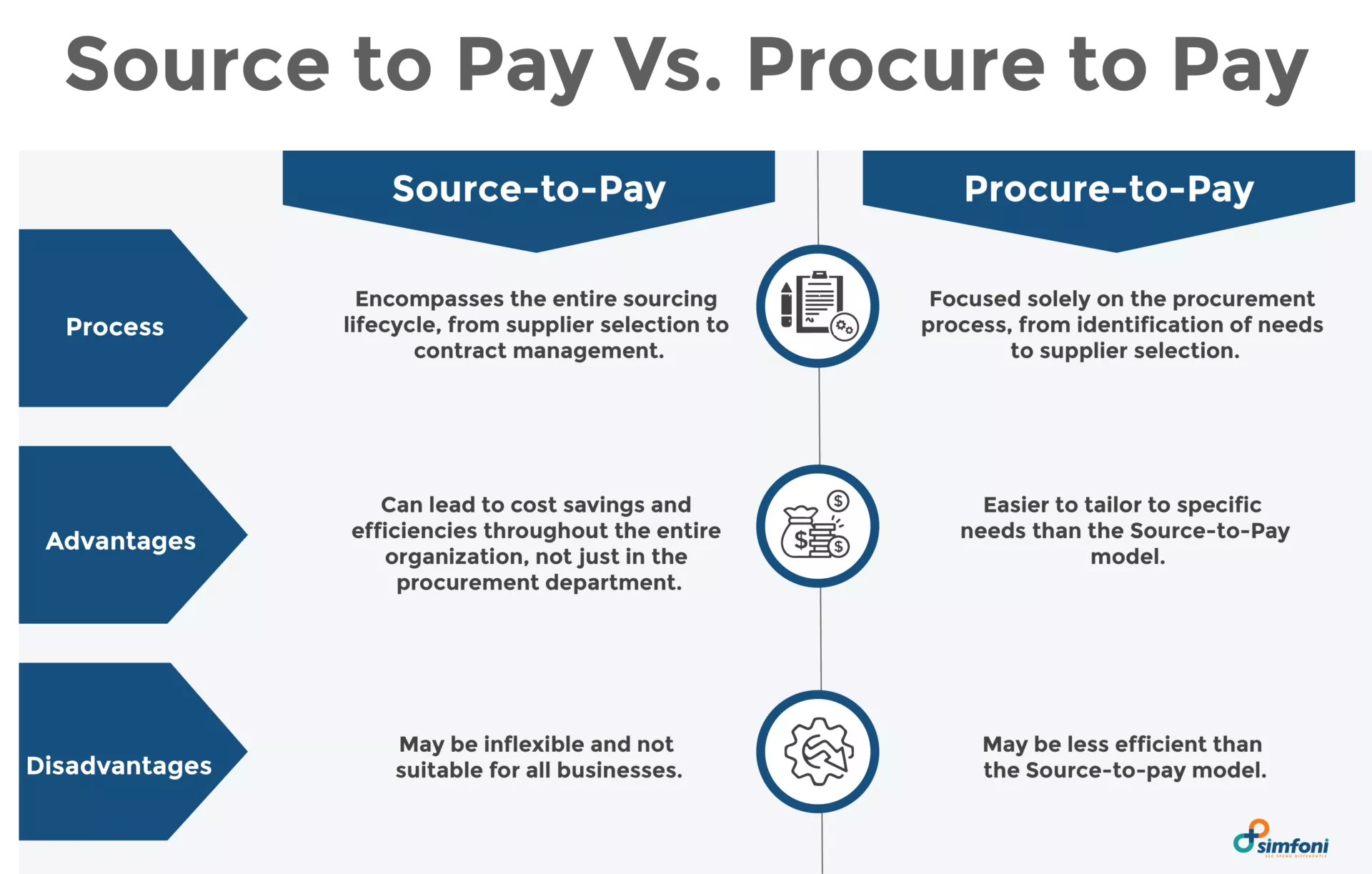

Procure-to-Pay Vs. eProcurement?

Procurement is the process of acquiring products or services, usually in the business world. Everything from acquiring products and services to negotiating agreements, ordering, guaranteeing proper delivery and quality, and managing payments fall under procurement. This procedure has several details and sub-activities. Procurement encompasses the entire picture, yet depending on the company, an organization’s procurement solution may or may not comprise many distinct components.

A manufacturing facility, for example, may have different procurement requirements than a film studio, yet both must buy commodities and services to succeed. Because every organization has unique requirements, procurement solutions should be tailored to meet those requirements rather than being one-size-fits-all. Today, e-procurement refers to cloud-based procurement software that enables companies to execute their purchases online.

What does it mean to Procure to Pay?

Procure-to-pay is a subset of procurement that does not include sourcing. As a result, after a company has identified its suppliers, it will turn to a procure-to-pay solution to automate the rest of the process.

Procure-to-pay software assists businesses in managing their purchasing processes by allowing them to place orders digitally, handle approvals, and track shipments and payments. Companies may get greater control and visibility into their whole procurement activities by using tools like 3-way checks between purchase orders, goods receipts, and invoicing.

Even though many people use several procurement-related terminologies interchangeably, knowing the actual definitions of procurement vs. Procure-to-pay is important. Procurement is a broad term that encompasses a wide range of purchasing operations. Procure-to-pay is primarily concerned with the operations that take customers from placing an order to receiving their goods.

The Procure-to-Pay Cycle’s Essential Best Practices

There are no two firms that are alike. Best practices, on the other hand, are meant to accept variances and allow each firm to identify areas in need of development, then build and formalize workflows, protocols, and procedures that will result in efficiency, cost savings, and other benefits desired.

For the highest return on your procurement money, consider using these P2P best practices :

1. Automate to Reduce Expenses, Errors, and Excess Stress

You’ll need the correct tools to get the greatest outcomes from any business procedure. Automation—specifically, a fully built, cloud-based procurement system with support for data management and analysis—is one of the most important requirements for any firm serious about improving their procure-to-pay process in today’s fast-paced, always-on marketplace.

Automation benefits all aspects of procurement, but it shines brightest in the P2P cycle. Intelligent features such as built-in three-way matching and supplier relationship management/contract management can help organizations achieve massive gains in efficiency, cost-effectiveness, and decision making by automating common workflows, increasing data transparency, and eliminating common procurement process woes like invoice fraud, rogue spend, and supply chain bloat.

Top-of-the-line procurement management solutions can be standalone applications or seamlessly integrated with existing enterprise resource management systems (ERP systems) to bring all business units together for faster, mobile-friendly collaboration and easy adoption of process improvements across the entire organization.

Beginning with purchase requisitions and continuing through vendor payment and financial record reconciliation, automation, and artificial intelligence allow you to construct unique « touchless » workflows with built-in contingencies and alarms. All operations are significantly faster and more accurate, lowering cycle times for purchase orders and invoicing, by removing the human element—and errors !—from data input, document routing, and three-way matching.

All transaction data and accompanying documents are gathered and saved automatically on a single, cloud-based server for real-time access and analysis from home, the office, or on the road. Instead of manually inputting data or tracking down exceptions, employees may focus on higher-value work.

Supply management and strategic sourcing are also substantially enhanced; suppliers may be reviewed and on-boarded from the very first transaction, and their performance can be followed using whichever KPIs are most important in your P2P cycle. Faster processing times, data analysis to find potential for mutually beneficial partnerships, and stronger contract negotiation backed by real performance and industry statistics may all help to develop and enhance supplier relationships.

These are just a few of the advantages that a high-quality, automated procurement system may give. Your team can handle the guts and bolts of building particular best practices much more successfully if you start with automation, data analysis tools, and centralized, mobile-friendly data management.

2. Make standardization a top priority

The first step is to get the correct tools. Making sure everyone is on the same page and following the same playbook is the second stage in P2P optimization. To achieve and maintain quantifiable progress, standardization is required.

A successful standardization strategy is as follows :

- Has C-suite support and a cultural mandate emphasizing the significance of compliance in accomplishing company objectives.

- Defines the duties and responsibilities of everyone participating in the procure-to-pay process thoroughly and explicitly.

- Provides training (with periodic refreshers) on the use of procure-to-pay software and other tools used throughout the P2P process for staff, management, and the C-suite.

- Establishes specific expenditure management policies that emphasize the necessity of adhering to processes, as well as any possible repercussions for non-compliance.

- Focuses on simplicity to reduce unnecessary complexity and confusion while yet allowing for further development as needed.

3. Gather and Use Data to Define and Achieve Objectives

After you’ve got your software tools in place and your team on board, the next stage in P2P optimization is to ask and answer an important question: What aspects of our P2P process can be enhanced to help us reach our objectives?

There is no wrong answer to this issue; data management solutions make capturing and analyzing data over the whole p2p cycle considerably easier. However, you can’t measure what you can’t see, so having complete visibility of your expenditure data, as well as role-appropriate access for all parties to do analysis, is essential.

Your team will be able to correctly monitor current performance thanks to this visibility and control, allowing them to identify issue areas and design procedures and processes to adequately address them.

4. Collaborate and connect

Any effort to improve your procure-to-pay process must have total buy-in from all levels, as well as the communication tools and training needed to avoid misunderstandings and build a feeling of shared purpose.

It’s much easier to ensure key stakeholders can connect easily and access shared resources needed to complete something as simple as a purchase order approval or as complex as a contract negotiation when everyone is operating within the framework of the eProcurement solution and following standardized protocols.

Your team will be able to correctly monitor current performance thanks to this visibility and control, allowing them to identify issue areas and design procedures and processes to adequately address them.

Conclusion

Procure-to-pay software solutions may help you improve compliance and control among suppliers, contracts, regulations, buyers, and accounts payable by digitizing your procurement process.

Frequently Asked Question (FAQ)

What is P2P (Procure to Pay)?

P2P, or Procure to Pay, is a comprehensive business process that covers the entire procurement cycle within an organization. It encompasses all the steps from identifying the need for a product or service to making the final payment to suppliers. P2P typically involves activities such as requisitioning, supplier selection, purchase order creation, goods receipt, invoice processing, and payment authorization.

What is difference between P2P & procurement?

Procurement is the expansive umbrella term that envelops all the intricate maneuvers involved in obtaining and overseeing the acquisition of goods and services crucial for an organization’s operations. This encompasses the intricate dance of supplier selection, shrewd negotiation, and meticulous contract administration.

On the flip side, P2P or Procure-to-Pay takes a magnifying glass to the nitty-gritty operational facets of procurement. Here, spotlight shines on the tactical choreography of creating purchase orders. This meticulously receives goods or services, orchestrating the seamless processing of invoices, and the timely disbursement of payments to suppliers. In essence, P2P is the hands on, boots on the ground execution of the broader procurement strategy.

What is the difference between Procure to Pay (P2P) and Accounts Payable (AP)?

Procure to Pay is the end to end procurement process. It starts with identifying the need for a product or service and ends with making payments to suppliers. It encompasses procurement activities. These activities can be requisitioning, purchase order creation, goods receipt, invoice processing and payment authorization.

Accounts Payable (AP), on the other hand, is a specific function within finance that focuses on managing and processing supplier invoices and making payments. AP is a subset of the P2P process and deals primarily with the financial aspects of paying suppliers.

What is an example of Procure to Pay?

An example of a Procure to Pay process might involve a manufacturing company needing raw materials for production. Here’s how it works:

- Need Identification: The production department identifies needs for a specific quantity of raw materials.

- Requisition: A purchase requisition is created detailing required materials and specifications.

- Supplier Selection: The procurement team selects suitable supplier based on price, quality and other factors.

- Purchase Order: A purchase order is generated and sent to the chosen supplier. It specifies quantity and price as well as delivery date.

- Goods Receipt: Upon delivery, the receiving department checks the received materials against the purchase order.

- Invoice Processing: The supplier sends an invoice for the delivered materials, which is matched with the purchase order and goods receipt.

- Payment Authorization: Once the invoice is validated, it is approved for payment.

- Payment: The finance department makes the payment to the supplier, completing the Procure to Pay cycle.

Why is P2P used?

P2P is used for several important reasons:

- Efficiency: It streamlines and automates procurement processes, reducing manual work and errors.

- Cost Control: P2P helps organizations negotiate better terms with suppliers and identify cost-saving opportunities.

- Transparency: The process provides visibility into procurement activities, improving accountability.

- Compliance: P2P ensures that procurement activities adhere to legal and organizational policies.

- Supplier Management: It facilitates better supplier relationships and performance monitoring.

What is 3-way matching in P2P?

The P2P process incorporates a pivotal step known as 3 way matching. This intricate maneuver involves the meticulous scrutiny and harmonization of three crucial documents: purchase orders, goods receipts, and supplier invoices. The goal is to create seamless alignment, ensuring precision and thwarting any potential discrepancies. Here the intricate choreography:

- Purchase Order: The details on the supplier’s invoice are compared to the corresponding purchase order to verify that the quantities, prices, and items match.

- Goods Receipt: The goods receipt, confirming the actual receipt of the ordered items, is checked against the purchase order and supplier invoice to ensure alignment.

- Supplier Invoice: The supplier’s invoice is cross-referenced with the purchase order and goods receipt to confirm that all elements match, indicating that the transaction is accurate and can proceed for payment.

This 3-way matching process helps organizations maintain financial accuracy, prevent overpayment or underpayment, and minimize disputes with suppliers.

How can automation enhance the P2P process?

Automation can significantly enhance the P2P process by:

- Streamlining Workflow: It automates repetitive tasks like data entry, reducing processing time.

- Error Reduction: Automation minimizes human errors in purchase orders, invoices, and payments.

- Document Management: It provides a centralized platform for storing and accessing procurement documents.

- Compliance: Automation ensures adherence to procurement policies and regulatory requirements.

- Analytics: It offers data insights for better decision-making and cost optimization.

What challenges can organizations face when implementing P2P systems?

Implementing P2P systems can present challenges such as:

- Resistance to Change: Employees may resist adopting new digital processes.

- Integration: Ensuring seamless integration with existing systems can be complex.

- Data Quality: Inaccurate or inconsistent data can hinder automation efforts.

- Supplier Engagement: Encouraging suppliers to participate in electronic transactions can be a challenge.

- Cost: Initial investment and ongoing maintenance costs can be substantial.

How can organizations improve supplier relationships through P2P?

Organizations can enhance supplier relationships through P2P by:

- Transparent Communication: Maintaining open and clear communication with suppliers.

- On-Time Payments: Ensuring timely and accurate payments to suppliers.

- Collaboration: Collaborating on cost-saving initiatives and process improvements.

- Feedback: Providing feedback and performance evaluations.

- Supplier Portals: Offering self-service portals for suppliers to track orders and invoices.

What role does data analytics play in P2P?

Data analytics in P2P enables organizations to:

- Identify Cost Savings: Analyze spending patterns and identify opportunities for cost reduction.

- Monitor Supplier Performance: Track supplier performance metrics and identify areas for improvement.

- Predictive Analytics: Use historical data to make predictions and optimize procurement decisions.

- Compliance Monitoring: Ensure adherence to procurement policies and regulatory requirements.

- Risk Management: Identify and mitigate risks in the procurement process.

How can organizations ensure compliance in the P2P process?

Ensuring compliance in the P2P process involves:

- Policy Documentation: Clearly defining procurement policies and procedures.

- Training: Providing training to staff involved in the P2P process to ensure awareness of policies.

- Audit Trails: Maintaining detailed records of procurement activities for auditing purposes.

- Automated Approval Workflows: Implementing approval workflows that adhere to compliance requirements.

- Regulatory Adherence: Staying updated with and adhering to relevant procurement regulations.

Can P2P processes be customized to fit specific organizational needs?

Yes, P2P processes can be customized to align with an organization’s unique requirements. This customization may involve:

- Configurable Workflows: Adapting the workflow to match specific approval processes.

- Supplier Onboarding: Tailoring supplier onboarding procedures to meet organizational standards.

- Document Templates: Customizing purchase order, invoice, and contract templates.

- Data Fields: Adding or modifying data fields to capture specific information.

- Integration: Integrating with other systems and applications as needed.

What is role of technology in modernizing P2P process?

- Automating Tasks: Reducing manual effort in purchase order creation, invoice processing, and payment.

- Enhancing Visibility: Providing real-time visibility into procurement activities.

- Improving Accuracy: Minimizing errors and discrepancies in procurement documents.

- Enabling Mobility: Allowing for remote access and approval of procurement transactions.

- Data Analytics: Offering insights for better decision-making and cost optimization.

How can organizations measure the effectiveness of their P2P process?

Organizations can measure the effectiveness of their P2P process by:

- Key Performance Indicators (KPIs): Tracking KPIs such as cost savings, cycle time, and supplier performance.

- Benchmarking: Comparing P2P performance against industry benchmarks.

- Supplier Feedback: Gathering feedback from suppliers on their experience.

- Audit and Compliance: Assessing adherence to procurement policies and regulatory requirements.

- Data Analytics: Analyzing data to identify areas for improvement and optimization.

How does P2P contribute to cost control and savings?

P2P contributes to cost control and savings through:

- Streamlined Processes: Reducing manual work and process inefficiencies.

- Supplier Negotiation: Optimizing terms, prices, and discounts through negotiation.

- 3-Way Matching: Preventing overpayment or underpayment by matching purchase orders, goods receipts, and invoices.

- Data Analytics: Identifying cost-saving opportunities and spending patterns for better decision-making.

- Supplier Relationship Management: Collaborating with suppliers for cost reduction initiatives.

Useful Resources

- Cost Reduction Strategies in Procurement.

- Effective Procure-to-Pay Process Guide (P2P Procurement).

- Guide to eProcurement software & Solutions.

- Guide to Manage Tail Spend and Improve the Bottom Line.

- Guide to Procurement Software & eProcurement Solution.

- Guide to Understanding Category Management in Procurement.

- Leveraging AI & Machine Learning in Procurement.

- Procurement Analytics & Implementation.

- Procurement Management - Key Steps and Roles.

- Procurement Marketplace - Reinventing Procurement

- Savings Tracking Process in Procurement.

- Source to Pay Process, Steps & Definition.

- Spend Analysis in Procurement: Importance, Process & Examples.

- Supplier Diversity in Procurement

- Sustainable Procurement - Importance & Best Practices

- Understanding the What, Why, & How of Strategic Sourcing.

- Procurement Auctions – How It Works, Example, and Risks.

- Supply Chain Management (SCM): How It Works and Why It Is Important

- What is Contract Management - Everything You Need to Know

- B2B Marketplace - The Ultimate Guide to Procurement Marketplace

- Spend Management - Importance & Best Practices On Business Spend Management Software & Solutions

- Strategic Sourcing – Ultimate Guide To Strategic Sourcing Processes

- Spend Cube – Ultimate Guide to Spend Cube Analysis

- Procurement Software - Automate Your Procurement Process