Composable Spend Management Technology that Fits Regardless of Your Size Expertise Maturity Location

Modular, purpose-driven solutions that help you to see, source, and manage your procurement spend differently.

Fit-to-purpose technology solutions to help you see, source, and manage procurement spend differently.

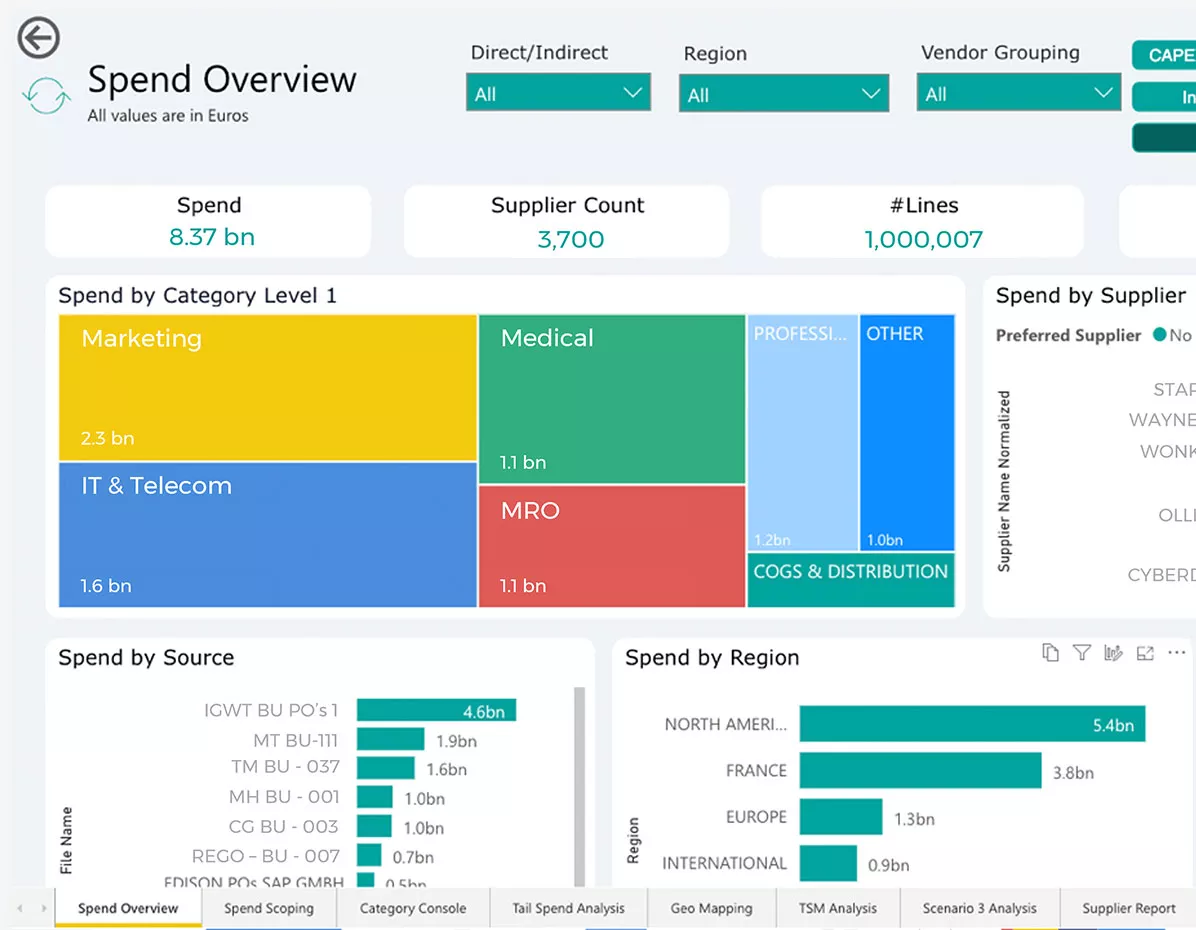

Spend Analytics

eSourcing

Spend Automation

We’ve fused revolutionary technology with AI-enabled content and deep expertise to automate, streamline and simplify procurement. The result: a composable, on-demand spend management platform that takes the hassle out of procurement. Welcome to effortless Spend Management.

Simfoni & Kearney Join Forces to Revolutionize Tail Spend Management

Simfoni partners with industry-leading consulting expert Kearney to advance revolutionary composable tail spend management solution and service delivery model.

Great Spend Management Starts with Detailed Spend Analysis.

Learn about the benefits of Simfoni's Spend Analytics Platform.

With our AI-powered spend analytics solution, all your direct and indirect spend is accurately classified and interrogated. You gain real-time visibility, as well as actionable insights to identify new opportunities and uncover hidden savings.

- Benchmark Performance

- Opportunity Identification

- Purchase Price Variance

- P-Card Analysis

- ESG Reporting & KPIs

- Improve Spend Visibility

- Increase Spend Compliance

- Manage Supplier Diversity

- Empower Category Management

- Reduce Maverick Spend

Make Better Sourcing Decisions In Less Time

A user-friendly eSourcing and Optimization solution that offers advanced automation and unique insights to help users identify the best decisions in less time.

eSourcing presents significant cost savings for procurement teams. Save time, boost efficiency, and decrease the time it takes to award a contract.

- Sourcing Pipeline

- Decision Optimization

- Supplier Onboarding

- Savings Tracking

- Contract Management

- Increase Supplier Transparency

- Reduce Costs

- Optimize Approval Processes

- Simplify Procurement Intake

- Fully Digitize Sourcing Processes

Bring More of Your Procurement Spend Under Management

Best-of-breed tail spend management solutions to help you tackle all of your organization's most unloved spend.

Whether you call it tail spend, maverick spend, or just plain unmanaged spend - our Spend Automation solution delivers embedded sourcing, content and payments to help you reap the benefits of proper spend management. Learn how our technology and strategic resources will help you improve efficiencies and skyrocket savings.

- Marketplace

- Indirect Category Experts

- BuyDesk

- Analysis of Your Spend

- Category-Driven Savings Plan

- Embedded Sourcing

- Supplier Payments

- Eliminate Maverick Spending

- Increase Spend Under Management

- Reduce Overall Transactions

- Improve Compliance

- Reduce Risk

- Streamline Processes

- Improved Buying Experience

Trusted by Procurement. Loved by All.

Delivering the technology, resources and expertise to help you achieve the outcomes you seek for your organization.

- Procurement

- Finance

- Private Equity

- Partnerships

Simfoni’s outcome-driven solutions are purpose-built to accommodate the needs of global procurement teams. We have designed our solutions with the user’s journey and workflows in mind.

Whether you are looking for an ‘all-in-one toolkit’ or to get more return from your existing technology investments, Simfoni has a solution to help you achieve the outcomes you seek.

Contact Simfoni today to get started.

Simfoni is changing the game for Finance teams that need better visibility and control of their spend. Simfoni has a team of procurement experts on staff to help you build a strategy to identify and eliminate wasteful spending and skyrocket savings.

Contact Simfoni today to get started.

Learn how Simfoni Spend Management solutions are helping some of the world’s largest private equity firms to recession-proof their portfolios and deliver net new value-creation strategies.

Starting with a cube of cubes view of your portfolio spend, Simfoni can help you identify areas to increase efficiencies, improve cross-portfolio collaboration, and generate net new cost-reduction strategies across your portfolio (and within individual accounts!)

Contact Simfoni to learn more about our solutions for Private Equity.

Simfoni partners with organizations across the globe to deliver access to superior spend insights, expert resources, and best-of-breed spend management solutions.

Whether you are a consultant, technology or managed service provider, or want to learn more about our referral network, get in touch with Simfoni to learn about the value of a strategic partnership with Simfoni.

Contact Simfoni today to get started.

OUR VALUED CLIENTS

Gartner named Simfoni a Sample Vendor in the 2023 Hype Cycle for Procurement and Sourcing Solutions

Learn why Simfoni's tail spend management solution is capturing the attention of industry experts across the globe.

Leverage deep, actionable insights across all direct and indirect spend data.

With our AI-powered spend analytics solution, all direct and indirect spend data is accurately classified and interrogated. You gain real-time visibility across all categories, as well as actionable insights to identify new opportunities and hidden savings.