Simfoni manages tail spend for clients all over the world and across many different industries. But regardless of geography or sector, I have gained 2 important insights that are vastly out of sync with the common theory about tail spend; Number 1: Average savings on tail spend are not 7% (Source: Hackett, 2016) but more like 15-20%. Number 2: The size of the tail (unmanaged, uncontracted spend) is much more than the typical 20% that is commonly quoted; we’ve seen this range from 20% to as much as 60% of an organization’s 3rd party expenditure. The mode is around 40%.

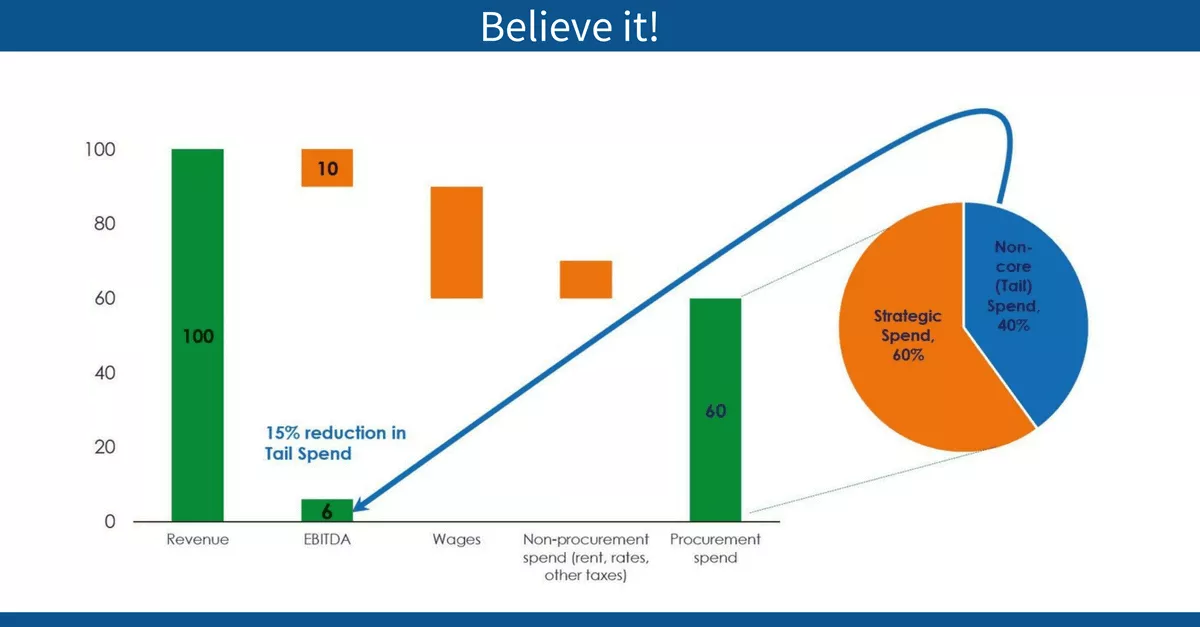

This is a big deal, because it means the impact from tail spend is much higher than everyone is thinking. If you consider that a typical organization’s tail spend is 40% of their spend, and the price reductions we can achieve are 15%, then that’s a 6% reduction in the total third party expenditure. Assuming a typical 10% net margin for the business, with third party costs equivalent to 60% of revenue, THAT’S EQUIVALENT TO A 60% POTENTIAL INCREASE IN EBITDA!

Read More:- What is Procurement and How To Optimize Processes, Performance, and Technology?

60% increase in EBITDA – from tackling something as benign as non-core expenditure? That’s too good to be true! So good in fact that I wouldn’t blame you for not believing me.

So, here’s some context that might help change your mind…

Remember, tail spend is that part of expenditure that is not ‘professionally’ managed; typically by a procurement department but not exclusively so. Of course not being professionally managed is not the same as not being well-managed. And here’s the rub; in managing non-core spend we see plenty of situations where we generate little or no price reduction; the purchase requirement had already been negotiated well by the end user. For example a Marketing Director who has commissioned a print run for a new brochure. This is the case in as many as 30-40% of cases. The opportunity for significant savings arises from the other 60-70% of cases. In these cases we see a variety of the following: 1) purchases not previously well-negotiated, 2) ‘poorly’ specified requirements, 3) purchases that are not aggregated. But when we do see savings opportunities, they are really significant.

- These days we don’t often see a purchase that has not been subjected to some kind of ‘competitive tendering’ or at the very least a request for discount of some kind. But in reality users’ effectiveness in achieving a decent outcome is wide-ranging. Often they have not had the time (after all doing the buying is not their main job), equally often they have not the negotiation skills, and sometimes they do not have the inclination to push pricing down further (read into that what you will). Needless to say, in these instances, we generate price reductions of 30-40%.

- But the second situation is even more interesting, and even more prevalent. Put simply, left to their own means, users will over-specify the products and services that they require. My favourite example is laptops. If we’re honest, most of us don’t know our RAM from our ROM, nor what level of processor is appropriate for the type of work that we do. Yet the difference in over-specifying each feature of a device (screen size, memory, processor, hard disk) is about 15% of the product cost. So it’s easy to see how an inappropriately specified device can cost 40-50% more than an over-spec’d one. Don’t even get me started on the benefits of discontinued models which can be up to 70% cheaper! The example is not limited to laptops. We see just about everything from print, packaging, IT Hardware, storage cabinets, furniture, material handling equipment, office supplies – all being specified at a level beyond the user’s requirement.

- And finally for the third argument, let’s not forget that if your tail spend service provider is regularly sourcing laptops in large volumes for lots of customers all the time, they should be able to squeeze out further hefty volume discounts. These can be as large as 15-30% depending on the circumstances.

So there you have it; 60% increase in EBITDA. Does the initiative you are working on have that kind of business impact? To find out more, drop us a line at Simfoni.com Learn more about Impact Assessment