In recent days Simfoni has developed a Covid-19 risk assessment dashboard to help its customers assess potential business impact arising from supply chain disruption. Given the acuteness of this situation we have decided to provide this dashboard on a complimentary basis in the interest of supporting businesses, jobs and maybe even lives.

In this article, I describe the methodology applied in our Covid-19 Risk Assessment so that readers can recreate the analysis and apply it to their own situations. Our assessment follows 3 stages; Identification, Supply Market Risk Analysis, and Mitigation.

Stage 1 – Identification

The core driver of C-19 risk surrounds the extent of ‘lockdown’ within each geographic region. ‘Lockdown’ principally results in i) various restrictions on people movement and ii) panic behaviour. Both trigger a number of supply chain risks associated with shortages, movement of goods or extreme demand for certain goods which can have unexpected knock-on effects for commodities. Geographic lockdowns themselves vary in scope and definition – some include travel and/or workplace bans, others don’t. Even within travel bans, some ban international flights but not domestic, some ban all flights. To further complicate matters the conditions are being amended daily. A comprehensive analysis would require continuous tracking of all the lockdowns of all the governments in the regions where your suppliers have their operations. It’s a lot of work if you are doing this manually.

This can be simplified by using a measure of active cases which serves as a proxy for the extent to which a country or region is impacted by restrictions. As a general rule, the more active cases, the more restrictions. A good source of this information is worldometers.info.

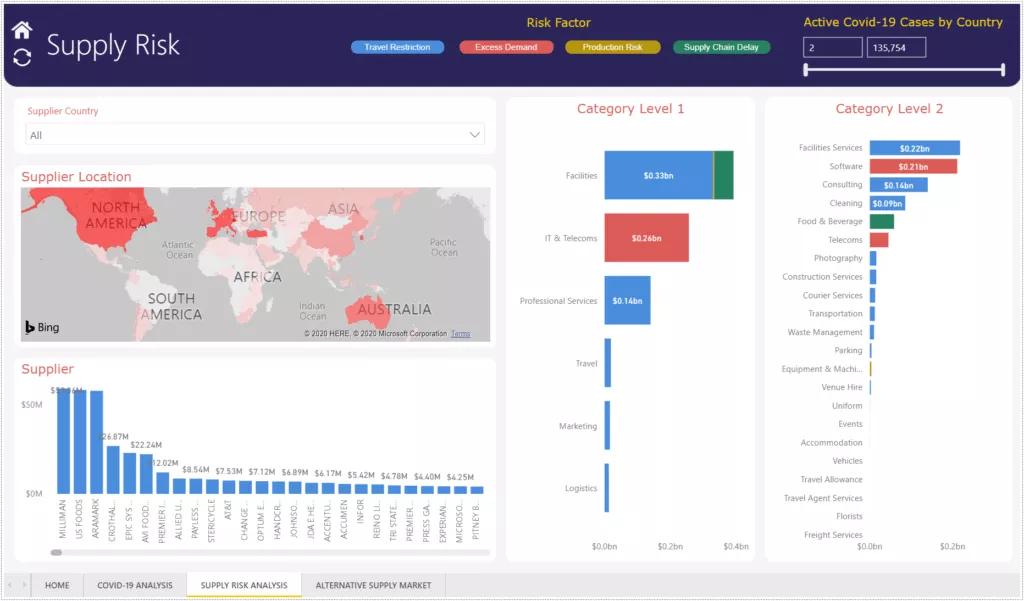

The first step is to map the current level of active cases of C-19 across the globe and then overlay your organization’s spend against this map. If you want to be proactive, you could look also at daily increases per capita as an early warning indicator of future trouble spots.

Now, the most important advice is to follow the categories, NOT the spend value. In situations where you have suppliers in regions with a high numbers of active cases, you should understand which categories of spend you are procuring from these regions. This is important because, as you will see later, the risks are pertinent to the nature of the categories not the level of spend. The more granular level at which you can do this the better; for example IT Hardware will include both Laptops (which are in scarcity in part due to working from home) and Desktops which are unaffected.

Stage 2 – Supply Market Risk Analysis

Now that you have identified risk by region, you should segment your risk by root cause. We have identified about a dozen risks associated with C-19 which for simplification we bundled into 4 groups: Production Risk, Excess Demand, Supply Chain Delay and Travel Restrictions.

Production Risk relates to items that cannot be produced because workers are unable to attend their place of work, essentially factory closures. Many raw material and manufacturing commodities will fall into this category, but also value-added food, beverages, and other FMCG.

Excess Demand pertains to items for which there is a huge increase in demand above normal levels; some obvious contenders are PPE, cleaning supplies and toilet paper(!) You may have Excess Demand from your own business too, and there are dual implications. In the first instance, securing supply of these items is a challenge; but the second implication (that is often missed) is that supply lines for related products are being diverted to support supply of these essential items. For example, provision of other disposable PPE such as industrial coveralls (for paint shop) are impacted as vendors switch capacity to make HAZMAT suits; similarly vinyl dish gloves and their sanitary equivalent. Some less obvious categories to bear in mind are IT – internet capacity is already being throttled in some places to manage Excess Demand, and even internet conferencing firms are building up waiting lists for on-boarding new customers.

The concept of Supply Chain Delay is well understood; categories may suffer delays at customs borders due to over-burdened demand or reductions in workforce impacting availability of duty officers, hauliers, drivers and so on. Again, do also consider secondary impacts; for example, passenger planes which are now grounded also carried a huge amount of air freight. Perishable goods bring additional risk on this dimension.

And finally, Travel Restrictions apply to those categories for which your suppliers’ staff are impeded from doing their work, potentially on your sites or at their own locations, that prevent them from continuing to provide those services. Facilities Management is an example where the corporate policies of your provider might impact your ability to literally keep the lights on at a facility of yours. Many services – both professional and non-professional – fall into this category. Of course government-imposed Travel Restrictions within a region may affect your own operations too and the agile procurement professional will want to explore vendors that can plug internal bottlenecks with substitute solutions; buying completed assemblies instead of doing your own assembly as an example.

Once you have crunched the data you should have something that looks like this – albeit not so colorful!

Stage 3 – Mitigation

Once you have completed the Risk Assessment, the final stage focuses on Mitigation. I would suggest first contacting existing vendors. It’s possible they have already mitigated against the concerned risks. Otherwise, you should explore with them collaborative or creative solutions that protect your supply. And in the worst case, they may also be able to help you with alternative vendors.

Should you opt to take up our offer of a complimentary Risk Assessment, we have a database of over 500,000 vendors globally and in many instances can suggest alternatives. The best place to start is to look amongst your existing supply base to explore alternate suppliers within the same category of spend in regions unaffected by the same risks. There are many other database registers from which you can identify potential vendors such as D&B or ThomasNet.

Many goods and services are not at risk since they don’t carry any criticality, or are not affected by the above risks. And in your budgeting, you might find it useful to also consider spend categories that will go down as a result of inactivity, the obvious one being Travel.

Finally, depending on the category, a thorough analysis would extend the same methodology to your Tier 2 and potentially even Tier 3 suppliers because that is where coping mechanisms may well be weaker.

Hopefully there is enough detail here to enable you to do this analysis yourself. That said, we’ve now loaded over 5000 country/category/risk combinations into our rules engine and the production of these reports is mostly automated; so if you would rather we did it for you, please get in touch. We’re happy to do this as long as we have the capacity.

I am sure there are other angles that we have not considered so please get in touch if you have other suggestions. For those of you in the trenches, I hope that you have found a few pointers here that make life better for your business and your staff; please consider sharing this with others that might also benefit.

Simfoni is proud to be featured as a Value Leader in the Spend Matters SolutionMap for Spend and Procurement Analytics. I am personally very grateful to Lisa, Jason and the Spend Matters team for their participation in supporting this communication.

Contact us today to know more about how Simfoni’s technology and processes can help your organization achieve world-class Spend Analytics and Spend Management Solutions. Stay Safe and let’s keep the wheels of the global economy turning.

About:- A Methodology for Addressing the Impact of Coronavirus.

by Chirag Shah, Chairman, Simfoni